Your Guide to Keeping Tabs on Your Credit Reports

3 min read

Your credit report is a window into your financial health, and keeping a vigilant eye on it is crucial in today’s dynamic financial landscape. This article serves as a comprehensive guide on how to effectively monitor your credit reports, offering insights into the importance of regular checks, the tools available, and proactive steps to protect your creditworthiness.

Understanding the Significance of Credit Monitoring: Your credit report influences major financial decisions in your life, from securing loans to determining interest rates. Regularly monitoring your credit reports allows you to detect errors, identify potential fraud, and ensures that your credit information accurately reflects your financial behavior.

The Three Major Credit Bureaus: Credit reports are maintained by three major credit bureaus—Equifax, Experian, and TransUnion. Each bureau compiles credit information from various sources, and discrepancies can exist between them. Monitoring reports from all three bureaus provides a comprehensive view of your credit profile.

Annual Credit Reports: By law, you are entitled to one free credit report from each of the major bureaus annually. Obtain your reports through AnnualCreditReport.com, a centralized platform that facilitates easy access. Reviewing these reports annually is an essential baseline for credit monitoring.

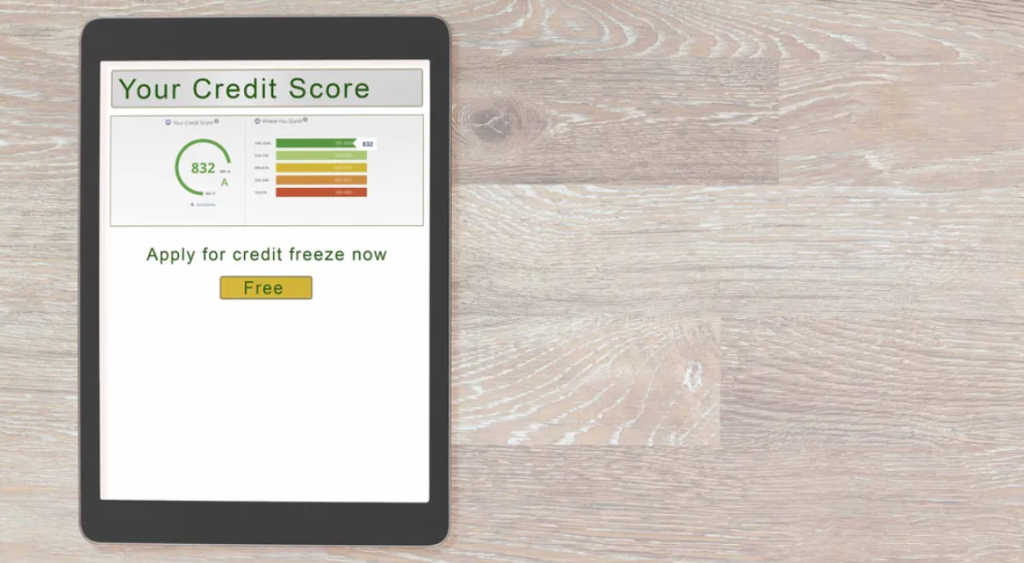

Credit Monitoring Services: Consider subscribing to credit monitoring services for ongoing, real-time monitoring. These services offer features such as credit score updates, alerts for significant changes to your credit report, and identity theft protection. While some are free, premium services often provide more robust features.

Set Up Fraud Alerts: Placing fraud alerts on your credit reports adds an extra layer of protection. If a creditor or lender sees a fraud alert, they are required to take additional steps to verify your identity before extending credit. Fraud alerts are typically valid for 90 days and can be renewed.

Free Credit Score Platforms: Many financial institutions and online platforms offer free credit score monitoring. While these scores may not be FICO scores, they provide a general sense of your credit health. Regularly checking these platforms allows you to track changes and potential issues.

Reviewing Your Credit Reports: When reviewing your credit reports, pay attention to the following:

Personal Information: Ensure your name, address, and other personal details are accurate.

Account Information: Verify the accuracy of your accounts, including open and closed accounts, balances, and payment history.

Inquiries: Check for unauthorized inquiries that may indicate potential fraud.

Detecting and Addressing Errors: If you identify errors on your credit report, take immediate action. Dispute inaccuracies with the respective credit bureau and provide supporting documentation. Timely resolution of errors is crucial for maintaining an accurate credit profile.

Monitoring Changes in Credit Scores: Keep an eye on changes in your credit scores. Significant drops may indicate potential issues, such as missed payments or identity theft. Address any negative changes promptly to mitigate their impact on your creditworthiness.

Staying Informed About Security Breaches: Be aware of security breaches that may affect your personal information. Many companies offer free credit monitoring services in the aftermath of a breach. Take advantage of these services to stay proactive in protecting your credit.

Regularly Update Passwords and Security Measures: Enhance the security of your financial accounts by regularly updating passwords and enabling two-factor authentication when available. Strong, unique passwords are essential in preventing unauthorized access.

Educating Yourself About Credit Rights: Understanding your rights as a consumer is crucial. Familiarize yourself with the Fair Credit Reporting Act (FCRA) and other relevant regulations that outline your rights and the responsibilities of credit reporting agencies.

Mastering the art of credit monitoring empowers you to take control of your financial well-being. Whether through annual free reports, credit monitoring services, or regular checks on free credit score platforms, staying informed allows you to detect and address issues promptly. By making credit monitoring a consistent part of your financial routine, you not only protect yourself from potential fraud but also ensure that your credit reports accurately reflect your financial responsibility and creditworthiness.